There are 'serious concerns' over how much funding will be needed for a green energy hub at the former Aberthaw power station.

A Senedd committee said the Cardiff Capital Region (CCR) project may require over £1 billion to fully redevelop the site.

A new report has criticised the performance of city and regional 'growth deals' in Wales, particularly in Cardiff and the North.

In June, it was revealed that the group of Welsh councils settled a legal dispute for £5.25 million after the High Court ruled a contract to demolish the power station had been awarded unfairly - with the findings of an independent review due to be published this Autumn.

The Aberthaw site was bought for £8.6 million in 2022 with a further £30 million allocated for demolition work, which is ongoing.

The Senedd's economy committee said that despite "strong investor interest" surrounding the project, it was concerned about the scale of funding needed and the potential impact on public finances.

Their report states: "We are concerned that the City Deal has purchased the site at Aberthaw and embarked upon a project that will require an as yet unspecified amount of money (possibly more than a billion pounds) in order to make it a success."

"A significant amount of this money will need to be secured from the private sector, meaning that it is all the more important that Cardiff Capital Region takes all steps possible to mitigate the impact of recent events on investor confidence."

Away from Aberthaw, the report also raises concerns that the CCR's work may only benefit certain parts of the region.

In June, the committee was told that the group was ''lagging slightly'' on its target to create 25,000 jobs - with many of those as a result of the South Wales Metro.

But members said they were surprised to hear there was no "conscious decision" to split the jobs target between the Metro and CCR's wider investment fund.

Andrew RT Davies, chair of the Senedd economy committee, said: "The four city and growth deals should be a key driver for economic growth in Wales and be creating a bright economic future."

"Proper monitoring and consistent leadership are essential to ensure all deals are supported to reach their ambitious targets and deliver on the significant public investment. Transparency, clarity, and long-term vision are essential."

The committee also called for serious clarity over funding for the North Wales growth deal, which has so far created only 35 jobs and led to just £1.8m of private sector investment, following the collapse of one of its key projects at Trawsfynydd in Gwynedd.

Great British Nuclear's decision not to pursue the site for a small modular reactor had a 'major impact' on the deal, having previously accounted for 12.5% of its job targets and 40% of its investment goals.

But the report did note "promising signs" from the Swansea Bay city deal, which had created nearly 900 jobs and attracted £133 million from private investors.

Support for Port Talbot and former Tata Steel workers was praised in the wake of the end of traditional production at the town's steelworks, but there were also concerns about the impact of inflation and the lack of flexibility in funding, compared to other growth deals.

Vale Councillor blasts school funding in the county

Vale Councillor blasts school funding in the county

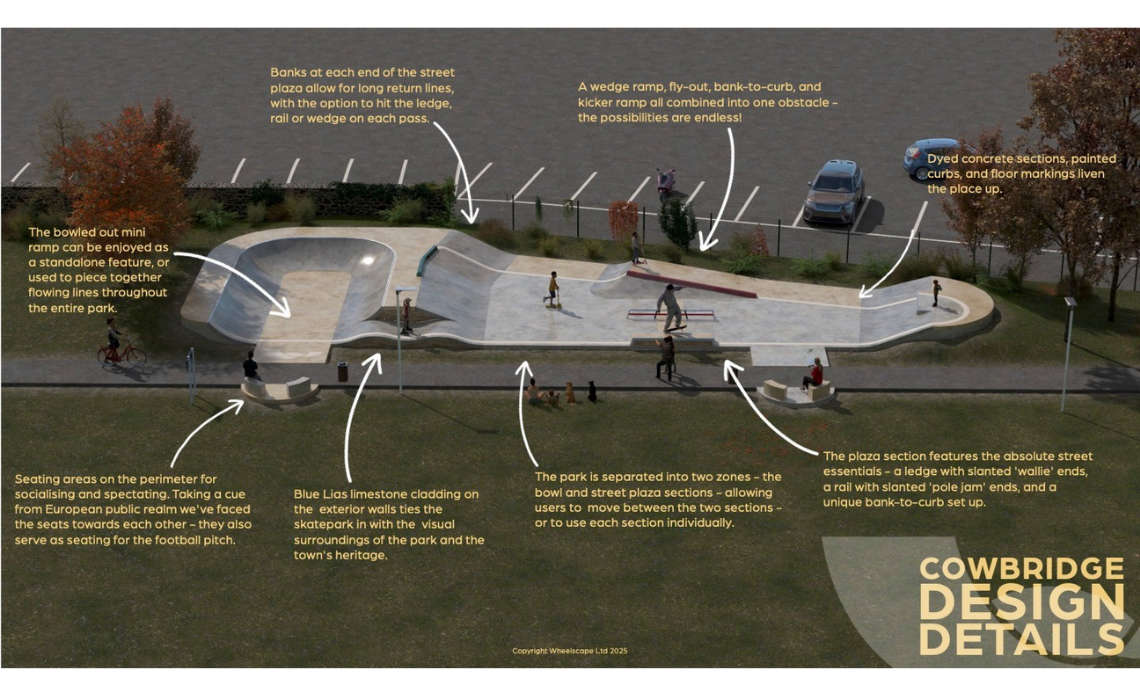

Bear Field Skate Park set for major upgrade as part of new Placemaking Plans

Bear Field Skate Park set for major upgrade as part of new Placemaking Plans

New apprenticeship courses in construction to be introduced in Wales

New apprenticeship courses in construction to be introduced in Wales

Former Penarth Bank could become a cafe

Former Penarth Bank could become a cafe

New poll shows majority of Welsh voters lack voting confidence ahead of Senedd Election

New poll shows majority of Welsh voters lack voting confidence ahead of Senedd Election

Construction hub secured for rail upgrades

Construction hub secured for rail upgrades

Prolific thief banned from Holton Road

Prolific thief banned from Holton Road

Cowbridge: plans for more holiday lodges

Cowbridge: plans for more holiday lodges

Man dies suddenly in Romilly Park

Man dies suddenly in Romilly Park

Cash boost for Sully Primary School

Cash boost for Sully Primary School

Speed limits reduced despite objections

Speed limits reduced despite objections

Concern over imported chicken in school meals

Concern over imported chicken in school meals

A48 closed after three-vehicle collision

A48 closed after three-vehicle collision

Rhys unveils red bench 'in living memory'

Rhys unveils red bench 'in living memory'

Barry: plans lodged for 70-home development

Barry: plans lodged for 70-home development

Plans to revamp Heritage Coast centre

Plans to revamp Heritage Coast centre

Carnival drummers join pirate opera encore

Carnival drummers join pirate opera encore