Wales' finance secretary has confirmed plans for a land value tax remain on the table as a potential long-term replacement for council tax and business rates.

Mark Drakeford said the Welsh Government continues to explore the feasibility of a land value tax as used in countries such as Denmark and Singapore.

The former First Minister has long supported a land value tax (LVT), arguing those who have the privilege of ownership should pay something back for that privilege.

While council tax is regressive because it imposes a lower burden on the rich than the poor, LVT is progressive as it flips that proposition around.

As the name suggests, land value tax (LVT), which has been described by some economists as the "perfect tax", is levied on the value of the land rather than the property itself.

'Radical'

Proponents argue LVT is easier to collect, more efficient and difficult to avoid, while discouraging speculation and encouraging people to bring idle land back into use.

Prof Drakeford told the Senedd: "I am anxious to see this discussion move beyond the theoretical and into the realms of the practically possible."

He explained that the Welsh Government has invited tenders to test approaches to valuing land, with submissions for every aspect of the work despite some initial scepticism.

The finance secretary, who will stand down at next year's election, said: "I want to use the coming months to test the boundaries of what might be possible in the next Senedd term."

"Let's open the door to more radical, fundamental and progressive reform in the future."

'Unfair'

In a statement on local taxes on Tuesday, Prof Drakeford highlighted ongoing consultations on council tax discounts and enforcement as well as business rates reform.

He said: "The current system is unfairly weighted against those who experience difficulty in paying. I want to shift the focus from harmful escalation towards supportive prevention."

Prof Drakeford stated ministers will introduce a new council tax appeals process by April 2026 that will be "easier to navigate and provide a better, modern system for taxpayers".

Peter Fox, who led Monmouthshire council for a decade, agreed that council tax is regressive by nature "and that it will never really become a fair local tax".

The Tory welcomed confirmation that the "crucial" 25% single person discount will remain but warned of the impact of continual increases in tax bills – including a 7.2% average this year.

'Flawed'

Mr Fox accused the Welsh Government of increasing tax on families "by stealth" through underfunding councils which, in turn, pass on the shortfall to people. He called for reform of the "outdated and flawed" local government funding formula.

Prof Drakeford replied: "Almost every local authority in Wales will agree that the formula needs revision – nobody can agree on how that should be done. The 22 local authorities each believe that the formula uniquely disadvantages them."

Heledd Fychan, Plaid Cymru's shadow finance secretary, agreed with the need for more radical and progressive change in the longer term.

Ms Fychan urged the Welsh Government to rethink proposals to stop considering a hospital as an individual's long-term or permanent home for council tax purposes.

The South Wales Central MS said: "We know of examples where people have had to remain for a very long time in hospital. It's not the patient's fault. It doesn't appear fair to me that they should be penalised."

Swapping date night for drysuits at Barry Dock RNLI

Swapping date night for drysuits at Barry Dock RNLI

13,900 French Rugby Fans fly into Cardiff Airport ahead of Six Nations Fixture

13,900 French Rugby Fans fly into Cardiff Airport ahead of Six Nations Fixture

Vale Councillor blasts school funding in the county

Vale Councillor blasts school funding in the county

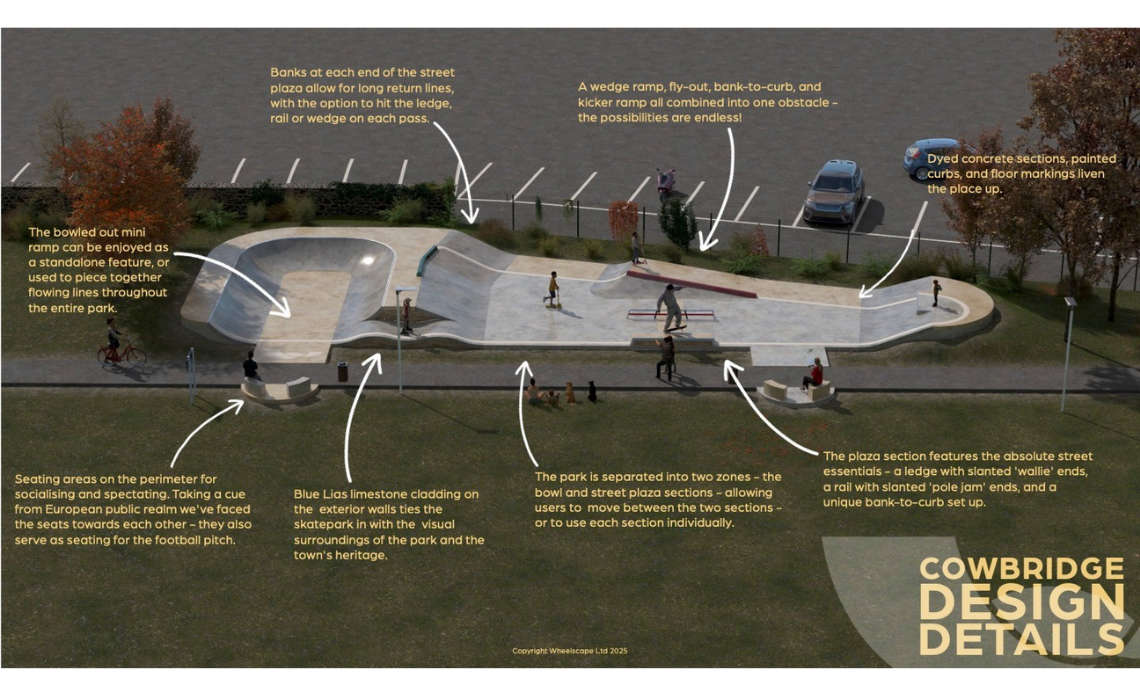

Bear Field Skate Park set for major upgrade as part of new Placemaking Plans

Bear Field Skate Park set for major upgrade as part of new Placemaking Plans

New apprenticeship courses in construction to be introduced in Wales

New apprenticeship courses in construction to be introduced in Wales

Former Penarth Bank could become a cafe

Former Penarth Bank could become a cafe

New poll shows majority of Welsh voters lack voting confidence ahead of Senedd Election

New poll shows majority of Welsh voters lack voting confidence ahead of Senedd Election

Construction hub secured for rail upgrades

Construction hub secured for rail upgrades

Prolific thief banned from Holton Road

Prolific thief banned from Holton Road

Cowbridge: plans for more holiday lodges

Cowbridge: plans for more holiday lodges

Man dies suddenly in Romilly Park

Man dies suddenly in Romilly Park

Cash boost for Sully Primary School

Cash boost for Sully Primary School

Speed limits reduced despite objections

Speed limits reduced despite objections

Concern over imported chicken in school meals

Concern over imported chicken in school meals

A48 closed after three-vehicle collision

A48 closed after three-vehicle collision

Rhys unveils red bench 'in living memory'

Rhys unveils red bench 'in living memory'

Barry: plans lodged for 70-home development

Barry: plans lodged for 70-home development